The Future of Carbon Credits: What to Expect in the Coming Years

The future of carbon credits is a topic of much discussion and speculation. Carbon credits is known as carbon offsets are a way for companies to offset their carbon emissions by purchasing credits from other companies that have reduced their emissions. The market for carbon credits has grown significantly in recent years, and many experts believe that it will continue to grow in the future.

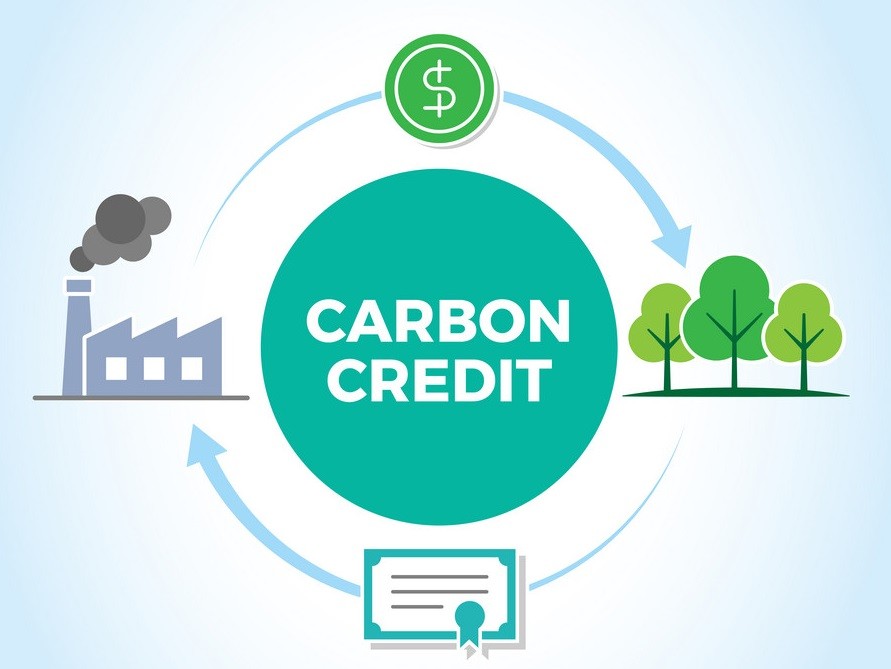

Understanding Carbon Credits

Carbon credits are a way for companies to offset their carbon emissions by purchasing credits from other companies that have reduced their emissions. The market for carbon offsets has grown significantly in recent years, and many experts believe that it will continue to grow in the future. However, there are concerns about the effectiveness of carbon credits in reducing greenhouse gas emissions, and there is a need for more transparency and accountability in the market.

Market Dynamics

The market for carbon credits is complex and dynamic, with many different players and factors at play. The price of carbon credits can be affected by a wide range of factors, including supply and demand, government regulations, and technological advancements. As the market for carbon credits continues to grow, it is likely that we will see more innovation and competition in the market, as well as more efforts to improve transparency and accountability.

Key Takeaways

- The market for carbon credits has grown significantly in recent years, and many experts believe that it will continue to grow in the future.

- There are concerns about the effectiveness of carbon offsets in reducing greenhouse gas emissions, and there is a need for more transparency and accountability in the market.

- As the market for carbon credits continues to grow, it is likely that we will see more innovation and competition in the market, as well as more efforts to improve transparency and accountability.

Understanding Carbon Credits

Definition and Mechanism

Carbon credits are a type of permit that allows companies to emit a certain amount of carbon dioxide or other greenhouse gases. These credits are traded on carbon markets, which are created to provide an economic incentive for companies to reduce their carbon footprint. The idea behind carbon offsets is that companies that can’t reduce their emissions to meet the required targets can buy carbon credits from companies that have reduced their emissions below the required targets.

The mechanism of carbon credits is simple: companies that reduce their emissions below their required targets can sell their excess credits to companies that are unable to meet their targets. The credits can be traded on an exchange, just like any other commodity. The price of carbon credits fluctuates depending on supply and demand, and other factors such as government regulations and the overall state of the economy.

Historical Context

Carbon credits have a relatively short history. They were first introduced in the late 1990s as part of the Kyoto Protocol, an international treaty aimed at reducing greenhouse gas emissions. Under the Kyoto Protocol, participating countries agreed to reduce their emissions to a certain level. Countries that were unable to meet their targets could purchase carbon offsets from other countries that had reduced their emissions below their targets.

Since then, carbon offsets have become an important tool in the fight against climate change. They provide an economic incentive for companies to reduce their carbon footprint and help to create a market for renewable energy and other low-carbon technologies. However, the use of carbon credits has also been controversial, with some critics arguing that they are not an effective way to reduce emissions and that they can be subject to fraud and abuse.

What are the problems with carbon credit trading?

The use of carbon credits has been criticized for several reasons. One of the main criticisms is that the system is too complex and can be subject to fraud and abuse. There have been cases of companies selling fake carbon credits or claiming to have reduced their emissions when they have not.

Another criticism is that carbon offsets do not provide a strong enough incentive for companies to reduce their emissions. Some critics argue that the price of carbon credits is too low to have a significant impact on companies’ behavior. Additionally, there is concern that carbon offsets can be used as a way for companies to avoid making real changes to their operations.

Despite these criticisms, carbon credits remain an important tool in the fight against climate change. They provide an economic incentive for companies to reduce their carbon footprint and help to create a market for renewable energy and other low-carbon technologies. As the world continues to grapple with the challenges of climate change, it is likely that carbon offsets will continue to play an important role in reducing greenhouse gas emissions.

Market Dynamics

Demand and Supply

The demand for carbon credits is increasing as companies and countries are taking steps to reduce their carbon footprint. This rise in demand is expected to continue in the future. According to a report by Allied Market Research, the global carbon credits market was valued at $2 billion in 2022 and is projected to reach $143.5 billion by 2032, growing at a CAGR of 55.5% from 2023 to 2032.

On the supply side, carbon offsets are generated by projects that reduce or remove greenhouse gas emissions. These projects can be located anywhere in the world, but the majority of the projects are in developing countries. The biggest sellers of carbon credits are companies that operate these projects, such as renewable energy companies, forestry companies, and waste management companies.

Key Players

The carbon credits market is dominated by a few key players. The Taskforce on Scaling Voluntary Carbon Markets estimates that 70% of the market is controlled by the top 10 sellers. These sellers include companies such as South Pole, ClimateCare, and EcoAct.

On the buyer side, the market is more fragmented, with a large number of companies and organizations purchasing carbon credits. These buyers include companies from a variety of industries, such as technology, finance, and energy. Governments and non-governmental organizations (NGOs) also purchase carbon credits.

Market Trends

One of the major trends in the carbon credits market is the increasing demand for high-quality carbon offsets. Buyers are looking for credits that are verified and have a clear impact on reducing emissions. This trend is expected to continue as companies and countries become more serious about reducing their carbon footprint.

Another trend is the rise of new technologies, such as blockchain, that are being used to track and verify carbon credits. These technologies can increase transparency and reduce the risk of fraud in the market.

Overall, the market for carbon credits is expected to continue growing in the future. As companies and countries take steps to reduce their carbon footprint, the demand for carbon offsets will continue to rise. The market will likely continue to be dominated by a few key players, but new technologies and trends may disrupt the market in the future.

Regulatory Landscape

The regulatory landscape of carbon credits is complex and constantly evolving. International policies and national regulations play a crucial role in shaping the market.

Regulatory Landscape

The United Nations Framework Convention on Climate Change (UNFCCC) oversees the international carbon market. The Paris Agreement, adopted in 2015, aims to limit global warming to well below 2°C above pre-industrial levels and pursue efforts to limit the temperature increase to 1.5°C. The agreement includes provisions for carbon credits, allowing countries to trade emissions reductions to meet their targets.

The Clean Development Mechanism (CDM) is a UNFCCC program that allows emission-reduction projects in developing countries to earn certified emission reduction (CER) credits. The CDM has faced criticism for its slow and bureaucratic process, but it remains an important mechanism for promoting sustainable development and reducing emissions.

National Regulations

Many countries have implemented their own regulations for carbon credits. The European Union Emissions Trading System (EU ETS) is the largest carbon market in the world, covering more than 11,000 power stations and industrial plants. Other countries, such as China, Japan, and South Korea, have established their own carbon markets.

In the United States, the regulatory landscape for carbon offsets is complex and varies by state. Some states, such as California, have implemented cap-and-trade programs, while others have established renewable portfolio standards or other policies to promote clean energy.

Overall, the regulatory landscape for carbon credits is constantly evolving and can be difficult to navigate. It is important for market participants to stay up-to-date on the latest policies and regulations to ensure compliance and maximize opportunities.

Investment Perspective

Investment Opportunities

Carbon credits can be a good investment opportunity for those who are looking for a way to invest in the future of climate change. As the world moves towards a more sustainable future, the demand for carbon offsets is expected to increase. This means that the price of carbon credits is likely to rise, providing investors with a good return on their investment.

Investing in carbon credits can also be a way to diversify an investment portfolio. Carbon offsets are not tied to the performance of the stock market or other traditional investments, making them a good option for those who want to spread their risk.

Risks and Returns

While carbon offsets can provide a good return on investment, there are also risks associated with investing in them. One of the main risks is that the price of carbon credits can be volatile. The price of carbon credits is influenced by a range of factors, including government policies, economic conditions, and the supply and demand of carbon offsets.

Another risk is that the quality of carbon credits can vary. Some carbon offsets may not be as effective at reducing emissions as others, which can impact their value. It is important for investors to do their due diligence and research the quality of the carbon credits they are investing in.

Overall, carbon offsets can be a good investment opportunity for those who are willing to take on some risk. As the world moves towards a more sustainable future, the demand for carbon offsets is likely to increase, providing investors with a good return on their investment. However, it is important for investors to do their research and understand the risks associated with investing in carbon credits.

Technological Advancements

As the carbon credit market continues to grow, technological advancements are playing a significant role in shaping its future. Two key areas where technology is making a significant impact are innovations in trading and the impact of blockchain.

Innovations in Trading

The traditional method of trading carbon credits involves a centralized exchange where buyers and sellers come together to exchange credits. However, technological advancements are making it possible for trading to take place in a decentralized manner. This allows for greater transparency and efficiency in the trading process.

One such innovation is the use of blockchain technology. Blockchain provides a secure and transparent way of recording transactions, making it ideal for trading carbon credits. By using blockchain, carbon credits can be tracked from their creation to their retirement, ensuring that each credit is unique and cannot be double-counted.

Impact of Blockchain

The impact of blockchain on the carbon credit market is significant. It provides a secure and transparent way of recording transactions, reducing the risk of fraud and ensuring that each credit is unique. Additionally, blockchain can provide a way to verify the authenticity of carbon credits, which is essential in a market where there is a risk of counterfeit credits.

Another way in which blockchain is impacting the carbon credit market is by enabling the creation of new types of carbon credits. For example, blockchain can be used to track the carbon footprint of products and services, allowing them to be certified as carbon-neutral or carbon-negative. This creates new opportunities for companies to monetize their sustainability efforts and for consumers to make more informed purchasing decisions.

Overall, technological advancements are set to play a significant role in shaping the future of the carbon credit market. As the market continues to evolve, it will be essential for companies to stay up-to-date with the latest innovations and technologies to remain competitive.

Environmental Goals

Global Carbon Targets

The world is facing a climate crisis, and reducing carbon emissions is crucial to mitigating its impact. To achieve this, the United Nations Framework Convention on Climate Change (UNFCCC) has set a goal of limiting global warming to 1.5°C above pre-industrial levels by 2050. This goal requires a significant reduction in carbon emissions, and countries around the world are working to achieve it.

Role of Carbon Credits

Carbon credits play a crucial role in achieving these global carbon targets. The goal of carbon credits is to incentivize companies and organizations to reduce their carbon footprint. Carbon credits are a way to offset the carbon emissions that companies and organizations produce by investing in carbon reduction projects. These projects could include renewable energy, energy efficiency, and reforestation.

The use of carbon credits allows companies and organizations to reach their environmental goals while also supporting the growth of renewable energy and other carbon reduction projects. The carbon offsets market has grown significantly in recent years, and it is expected to continue to grow as more companies and organizations adopt sustainable practices.

Overall, the future of carbon credits is promising, as they play a critical role in achieving global carbon targets. As the world continues to prioritize sustainable practices, the use of carbon offsets will become increasingly important in reducing carbon emissions and mitigating the impact of the climate crisis.

Economic Implications

Impact on Industries

The implementation of carbon offsets has a significant impact on industries across the globe. Companies that emit high levels of carbon dioxide are required to purchase carbon credits to offset their emissions. This creates an incentive for companies to reduce their carbon footprint and adopt more sustainable practices. As a result, industries that have traditionally been heavy polluters, such as the energy and transportation sectors, are likely to experience a shift towards cleaner technologies and renewable energy sources.

The cost of carbon credits can also impact the competitiveness of industries. Companies that are required to purchase large quantities of carbon credits may find it difficult to compete with companies that have lower emissions. This can result in a shift in production to countries with less stringent emissions regulations, which could ultimately lead to a global increase in emissions.

Effect on Global Economy

The value of carbon credits is determined by supply and demand. As the demand for carbon offsets increases, so does their value. The current market price for one carbon credit is around $10-$15, but this is expected to rise as more countries and industries adopt carbon pricing schemes.

The implementation of carbon offsets is likely to have a significant impact on the global economy. The revenue generated from the sale of carbon credits can be used to fund renewable energy projects and support sustainable development initiatives. However, the cost of carbon credits can also increase the cost of goods and services, which can have a negative impact on consumer spending and economic growth.

Overall, the economic implications of carbon credits are complex and multifaceted. While they can provide a mechanism for reducing emissions and promoting sustainable development, they can also impact the competitiveness of industries and the global economy. As such, it is important to carefully consider the design and implementation of carbon pricing schemes to ensure that they are effective and equitable.

Future Projections

Predictive Models

Predictive models suggest that the demand for carbon credits will continue to grow in the coming years. According to experts and industry leaders, the demand for carbon credits is expected to rise as more countries and companies commit to reducing their carbon footprint.

2030 and Beyond

Based on demand projections from experts surveyed by the TSVCM, McKinsey estimates that annual global demand for carbon credits could reach up to 1.5 to 2.0 gigatons of carbon dioxide (GtCO2) by 2030. This is in line with the volume of negative emissions needed to reduce emissions in line with the 1.5-degree warming goal.

The future of carbon credits beyond 2030 is less certain. However, it is clear that carbon offsets will continue to play an important role in mitigating climate change. As more companies and countries commit to reducing their carbon footprint, the demand for carbon credits is expected to rise.

Overall, the future of carbon offsets looks promising. While there are still challenges that need to be addressed, such as ensuring the integrity of carbon credits, the growing demand for carbon credits is a positive sign that the world is taking action to address climate change.

Leave a Reply